When it comes to navigating the insurance claims process, it’s crucial to understand the ins and outs to ensure a seamless experience. From understanding the general steps to documenting the claim and investigating its validity, this journey is filled with twists and turns that can impact both insurers and policyholders. Get ready to dive into the world of insurance claims process like never before.

Overview of Insurance Claims Process

Insurance claims process involves several key steps from filing a claim to receiving compensation. It is crucial for both insurers and policyholders to have a smooth and efficient claims process to ensure timely resolution and customer satisfaction.

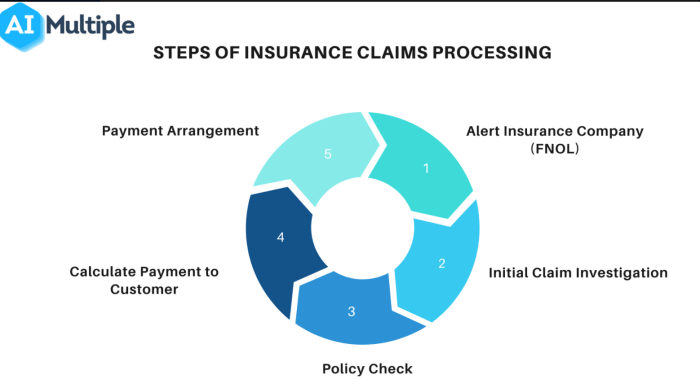

Key Steps in Insurance Claims Process

- 1. Filing a Claim: The policyholder reports the incident to the insurance company and provides necessary documentation.

- 2. Claim Investigation: The insurance company assesses the validity of the claim and investigates the circumstances surrounding the loss.

- 3. Evaluation of Loss: The insurer determines the extent of the loss and calculates the amount of compensation owed to the policyholder.

- 4. Settlement: Once the claim is approved, the insurer disburses the agreed-upon amount to the policyholder.

- 5. Claim Closure: The claim is closed once the policyholder receives the compensation and all relevant parties are satisfied.

Key Parties in Insurance Claim

- 1. Policyholder: The individual or entity who holds an insurance policy and submits a claim for compensation.

- 2. Insurance Company: The entity that provides the insurance coverage and processes the claim.

- 3. Adjuster: The representative of the insurance company who investigates the claim, evaluates the loss, and negotiates the settlement.

- 4. Third-Party: In cases involving liability claims, the third party is the individual or entity against whom the claim is filed.

Types of Insurance Claims

When it comes to insurance claims, there are several different types that individuals may need to file depending on the situation they are facing. Let’s take a closer look at the most common types of insurance claims and the scenarios that may lead to filing a claim in each category.

Auto Insurance Claims

- One common scenario that may lead to filing an auto insurance claim is getting into a car accident where you are at fault.

- Another example could be if your vehicle is stolen and you need to file a claim to cover the cost of replacing it.

Health Insurance Claims

- If you require medical treatment for an illness or injury, you may need to file a health insurance claim to cover the cost of your medical expenses.

- Regular check-ups, prescription medications, and hospital stays are all common scenarios that can lead to filing a health insurance claim.

Property Insurance Claims

- In the event of a fire, natural disaster, or burglary at your home, you may need to file a property insurance claim to cover the cost of repairs or replacements.

- Damage to your personal belongings, such as electronics, furniture, or clothing, could also be reasons for filing a property insurance claim.

Life Insurance Claims

- When a loved one passes away, beneficiaries may need to file a life insurance claim to receive the death benefit from the policy.

- Life insurance claims can also be filed to cover funeral expenses and outstanding debts left behind by the deceased.

Documenting an Insurance Claim

When filing an insurance claim, having the right documentation is crucial to ensure a smooth and successful process. The necessary paperwork provides evidence of the incident, helps determine coverage, and expedites the claim settlement.

Required Documents for Filing an Insurance Claim

- Policy information: Keep a copy of your insurance policy handy, as it Artikels the coverage details and conditions.

- Proof of loss: Provide evidence of the damage or loss, such as photos, videos, or written descriptions.

- Police reports: In case of theft, vandalism, or accidents, a police report may be required.

- Medical records: For health insurance claims, gather medical bills, prescriptions, and doctor’s notes.

- Repair estimates: Obtain estimates from repair shops or contractors for property damage claims.

Organizing Documentation Efficiently

To streamline the claims process, policyholders can organize their paperwork by creating a dedicated folder or digital file for all relevant documents. Label each document clearly and categorize them based on type (e.g., photos, receipts, reports) to easily access and submit when needed.

Importance of Accurate Documentation

Accurate and thorough documentation is essential for a successful insurance claim. It helps establish the validity of the claim, supports the evaluation of damages, and ensures that policyholders receive the appropriate compensation. Any missing or incomplete documentation can lead to delays or denials in claim processing.

Claim Investigation Process

When an insurance claim is filed, the insurance company initiates a claim investigation process to determine the coverage and liability. This process involves various professionals who assess the validity of the claim and investigate the details to ensure accuracy.

Role of Adjusters, Investigators, and Professionals, Insurance claims process

- Adjusters: These professionals are responsible for evaluating the claim, determining the extent of coverage, and negotiating settlements with the claimant.

- Investigators: They are tasked with gathering evidence, interviewing witnesses, and inspecting the scene to verify the details of the claim.

- Other Professionals: Medical experts, forensic accountants, and legal advisors may also be involved in assessing the validity of the claim and determining liability.

Methods Used in Claim Investigation

- Interviews: Adjusters and investigators conduct interviews with the claimant, witnesses, and other relevant parties to gather information and assess the validity of the claim.

- Inspections: Physical inspections of the property, vehicles, or other assets involved in the claim are conducted to verify the extent of damage and assess the accuracy of the claim.

- Reviewing Records: Adjusters and investigators review medical records, police reports, and other documentation related to the claim to gather evidence and determine liability.