Car financing options sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of car financing, where we’ll break down the various ways you can finance your dream ride, from traditional auto loans to alternative financing methods.

Overview of Car Financing Options

Car financing refers to the various methods individuals can use to purchase a vehicle without paying the full price upfront. It allows individuals to spread out the cost of the car over a period of time, making it more affordable for many people.

Types of Car Financing Options

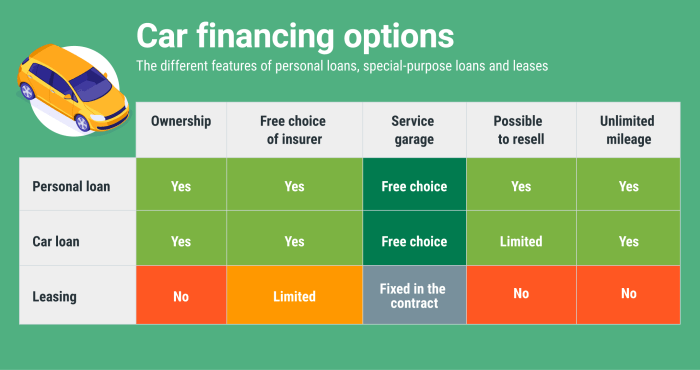

- Traditional Auto Loans: This is the most common type of car financing where the buyer borrows money from a lender and repays it with interest over a set period of time.

- Leasing: Leasing a car involves paying a monthly fee to use the vehicle for a specified period, typically 2-3 years. At the end of the lease, the car is returned to the dealer.

- Dealer Financing: Dealerships often offer financing options through partnerships with banks or financial institutions. This can sometimes result in special deals or promotions.

Importance of Understanding Car Financing

Understanding car financing is crucial before making a purchase to ensure you get the best deal possible. It’s important to consider factors such as interest rates, loan terms, and total cost of the loan. Being informed about the different financing options available can help you make a well-informed decision that aligns with your financial goals.

Traditional Auto Loans: Car Financing Options

When it comes to traditional auto loans, the process is quite straightforward. You borrow a specific amount of money from a lender, such as a bank or credit union, to purchase a car. This loan amount is then repaid over a set period of time, usually with monthly payments that include both the principal amount and interest.

Advantages and Disadvantages of Traditional Auto Loans

- Advantages:

- Lower interest rates compared to other financing options.

- Ability to negotiate terms such as loan amount and repayment period.

- Ownership of the vehicle once the loan is fully paid off.

- Disadvantages:

- Strict eligibility requirements, such as credit score and income verification.

- Potential for higher monthly payments due to longer loan terms.

- Risk of repossession if loan payments are not made on time.

Tips on How to Get the Best Deal on a Traditional Auto Loan, Car financing options

- Check your credit score and report before applying for a loan.

- Shop around and compare offers from different lenders to find the best interest rates and terms.

- Negotiate with the lender to see if there is room for a lower interest rate or better repayment terms.

- Consider making a larger down payment to reduce the overall loan amount and lower monthly payments.

- Read the fine print of the loan agreement carefully to understand all terms and conditions before signing.

Dealership Financing

When it comes to purchasing a car, dealership financing is a popular option that many buyers consider. This type of financing is offered directly through the car dealership where you are buying your vehicle.

Differences Between Dealership Financing and Traditional Auto Loans

Dealership financing and traditional auto loans have some key differences that buyers should be aware of:

- Dealership financing is typically faster to arrange compared to traditional auto loans from banks or credit unions.

- Dealership financing may have higher interest rates compared to traditional auto loans, but they often come with special promotions or discounts.

- Dealership financing may be more lenient with credit requirements compared to traditional auto loans, making it accessible to a wider range of buyers.

Negotiating Dealership Financing Terms

When it comes to negotiating dealership financing terms, here are some insights to keep in mind:

- Do your research beforehand to understand current interest rates and incentives offered by the dealership.

- Be prepared to negotiate not just the interest rate, but also the length of the loan and any additional fees.

- Consider getting pre-approved for a loan from a bank or credit union to have a benchmark for comparison during negotiations.

Lease Options

When it comes to car financing, leasing is another popular option that offers a different approach compared to buying a vehicle outright. Let’s dive into what car leasing entails and explore the pros and cons of this choice.

Car Leasing Defined

Car leasing involves essentially renting a vehicle for a specified period, typically 2-4 years, by making monthly payments. At the end of the lease term, you have the option to return the car or purchase it at its residual value.

Pros and Cons of Leasing

- Pros:

- Lower monthly payments compared to auto loans.

- Ability to drive a new car every few years.

- Minimal or no down payment required.

- Warranty coverage for the duration of the lease.

- Cons:

- No ownership of the vehicle at the end of the lease.

- Mileage restrictions and penalties for exceeding limits.

- Additional costs for wear and tear beyond normal usage.

- Early termination fees if you need to end the lease early.

Deciding on Leasing

Before deciding if leasing is the right choice for you, consider the following tips:

- Assess your driving habits and mileage needs to determine if lease restrictions align with your lifestyle.

- Evaluate your budget and financial stability to ensure you can afford the monthly lease payments.

- Compare leasing costs with buying costs over the long term to see which option makes more financial sense for you.

- Research lease deals and incentives offered by manufacturers to find the best possible lease terms.

Alternative Financing Methods

When it comes to financing a car, there are alternative options beyond traditional auto loans and dealership financing. These alternative financing methods, such as personal loans, credit unions, and online lenders, can offer different benefits and eligibility criteria for car buyers. Let’s explore these options in more detail.

Personal Loans

Personal loans can be a viable alternative to traditional auto loans for financing a car. With a personal loan, you can borrow a lump sum of money from a bank or online lender and use it to purchase a vehicle. The interest rates and terms of personal loans can vary based on your credit score and financial history. Personal loans may offer more flexibility in terms of repayment options compared to auto loans from dealerships.

Credit Unions

Credit unions are another alternative financing option for buying a car. Credit unions are member-owned financial institutions that may offer lower interest rates and more personalized service compared to traditional banks. To qualify for a car loan from a credit union, you typically need to be a member of the credit union and meet their eligibility criteria. Credit unions may be a good option for borrowers with less-than-perfect credit looking for competitive rates.

Online Lenders

Online lenders have become increasingly popular for car financing due to their convenience and competitive rates. Online lenders allow you to apply for a car loan from the comfort of your home and compare offers from multiple lenders. The application process for online car loans is often quick and straightforward, with many lenders providing instant decisions. Online lenders may be a good option for borrowers looking for fast approval and competitive rates.

Factors to Consider

When choosing a car financing option, there are several key factors to consider that can greatly impact your decision-making process. Factors such as credit score, interest rates, and loan terms play a crucial role in determining the overall cost and feasibility of your car financing. To help you navigate through the various options available, here is a checklist to evaluate different car financing options effectively.

Credit Score

One of the most important factors to consider when choosing a car financing option is your credit score. Lenders typically use your credit score to assess your creditworthiness and determine the interest rate you qualify for. A higher credit score can help you secure better terms and lower interest rates, while a lower credit score may result in higher interest rates or difficulty in getting approved for a loan.

Interest Rates

Interest rates play a significant role in the total cost of your car financing. Lower interest rates can save you money over the life of the loan, while higher interest rates can increase the overall cost of borrowing. It is essential to compare interest rates from different lenders to ensure you are getting the best deal possible.

Loan Terms

Loan terms, including the length of the loan and monthly payments, are important factors to consider when choosing a car financing option. Longer loan terms may result in lower monthly payments but can increase the total cost of the loan due to interest. Shorter loan terms may have higher monthly payments but can save you money on interest in the long run. It is important to choose a loan term that aligns with your budget and financial goals.