Customer Acquisition Cost, often referred to as CAC, is a crucial metric for businesses looking to thrive in today’s competitive landscape. From calculating CAC to strategies for lowering it, this topic delves into the core aspects that drive business success.

Definition of Customer Acquisition Cost

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This metric is crucial for businesses as it helps them understand how much they need to invest in marketing and sales efforts to bring in new customers and drive growth.

Calculating CAC in Different Industries

- In the e-commerce industry, CAC is calculated by dividing the total marketing and sales expenses by the number of new customers acquired during a specific period.

- For SaaS companies, CAC can be calculated by dividing the total sales and marketing expenses by the number of new customers acquired within the same period.

- In the retail sector, CAC is determined by dividing the total costs of marketing campaigns and promotions by the number of new customers gained as a result.

Significance of Understanding CAC for Business Growth

- Understanding CAC helps businesses allocate their resources effectively and efficiently towards acquiring new customers.

- By knowing their CAC, businesses can make informed decisions on which marketing channels and strategies are most cost-effective in acquiring customers.

- Monitoring CAC over time allows businesses to optimize their customer acquisition strategies and improve overall profitability.

Factors Affecting Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several key factors that can influence how much it costs for a business to acquire a new customer. These factors can have a significant impact on the overall effectiveness of a company’s marketing strategies and ultimately determine the success of their customer acquisition efforts.

One of the most important factors influencing CAC is the target market that a business is trying to reach. Different demographics and consumer segments may require unique approaches and channels for customer acquisition, which can affect the cost of acquiring each customer. Additionally, the level of competition in a particular industry can also impact CAC, as businesses may need to invest more resources to stand out and attract customers in a crowded market.

Marketing strategies play a crucial role in determining CAC as well. The channels and tactics used to reach potential customers can have varying costs associated with them, and the effectiveness of these strategies in converting leads into customers can directly impact CAC. For example, businesses that invest in highly targeted digital marketing campaigns may see a lower CAC compared to those that rely on more traditional, broad-based advertising methods.

Furthermore, the relationship between CAC and customer lifetime value (CLV) is essential to consider. While a lower CAC is generally desirable, it’s equally important to ensure that the value a customer brings to the business over their lifetime exceeds the cost of acquiring them. By calculating and optimizing the ratio of CAC to CLV, businesses can ensure that their customer acquisition efforts are sustainable and profitable in the long run.

Effect of Customer Retention

Customer retention plays a significant role in influencing CAC. Businesses that focus on retaining existing customers and fostering loyalty may see lower CAC as satisfied customers are more likely to make repeat purchases and refer others to the business. This can help offset the initial cost of acquiring customers and improve overall profitability.

- Implementing customer loyalty programs

- Providing exceptional customer service

- Personalizing marketing efforts based on customer preferences

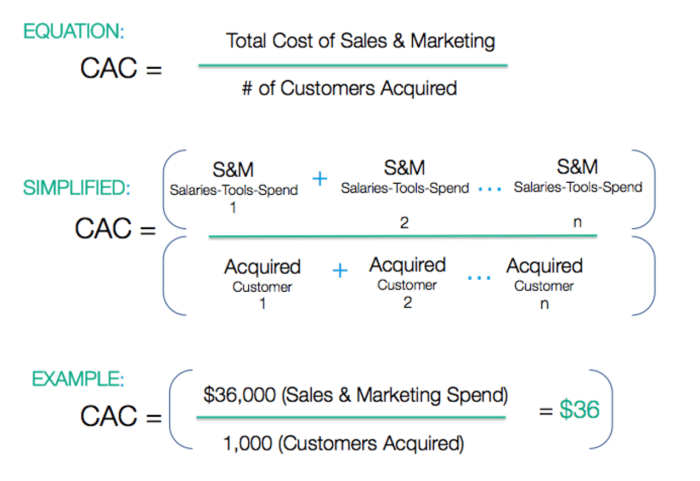

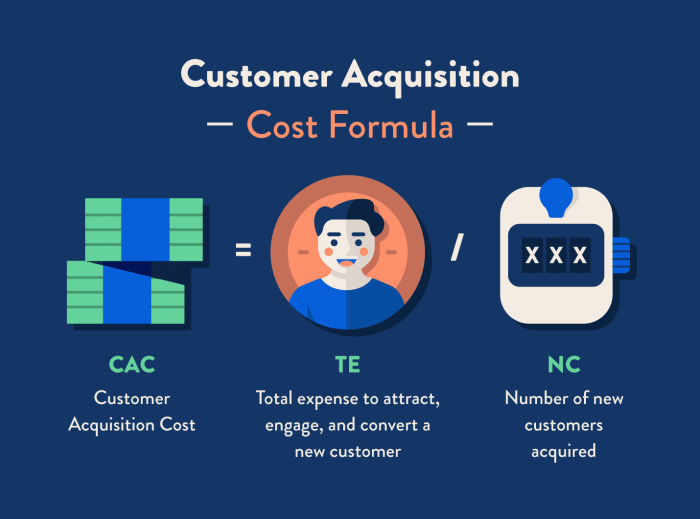

Calculating Customer Acquisition Cost

When it comes to calculating Customer Acquisition Cost (CAC), it’s crucial to have a clear understanding of the formula and the steps involved in determining this key metric. Accurate data plays a significant role in ensuring the precision of your CAC calculations.

Formula for CAC Calculation

CAC = (Total Marketing and Sales Costs) / Number of Customers Acquired

- Total Marketing and Sales Costs: This includes all expenses related to marketing and sales efforts, such as advertising, promotions, salaries, and overhead costs.

- Number of Customers Acquired: Refers to the total number of new customers gained during a specific period.

Step-by-Step Guide to Calculate CAC

- Sum up all marketing and sales expenses incurred during a specific period.

- Identify the number of new customers acquired within the same period.

- Divide the total marketing and sales costs by the number of customers acquired to get the CAC.

- For example, if you spent $10,000 on marketing and sales and acquired 100 customers, your CAC would be $100 ($10,000 / 100 = $100).

Importance of Accurate Data in Calculating CAC

Accurate data is essential for calculating CAC as it ensures the reliability and relevance of the insights derived from this metric. With precise information on marketing and sales costs and the number of customers acquired, businesses can make informed decisions regarding their acquisition strategies and optimize their resources effectively.

Strategies to Lower Customer Acquisition Cost

Lowering Customer Acquisition Cost (CAC) is crucial for businesses to improve profitability and sustainability. By implementing effective strategies, companies can optimize their marketing efforts and attract more customers at a lower cost.

Improving Customer Retention, Customer Acquisition Cost

One effective way to reduce CAC is by focusing on improving customer retention. By nurturing existing customers and providing excellent post-purchase support, businesses can increase customer loyalty and encourage repeat purchases. This not only lowers the cost of acquiring new customers but also boosts overall revenue.

Examples of Successful Businesses

- Amazon: Amazon has successfully lowered its CAC by leveraging its Prime membership program. By offering fast shipping, exclusive deals, and other benefits, Amazon has been able to retain customers and drive repeated purchases.

- Sephora: Sephora has reduced its CAC through personalized marketing strategies and a strong focus on customer experience. By providing tailored product recommendations and exceptional service, Sephora has built a loyal customer base that keeps coming back.

- Zappos: Zappos is another example of a company that has lowered its CAC by prioritizing customer satisfaction. With free shipping, hassle-free returns, and 24/7 customer support, Zappos has created a loyal customer following that continues to drive sales.

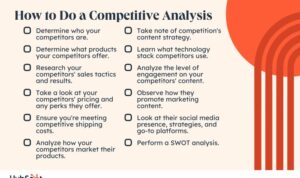

Benchmarking Customer Acquisition Cost

Benchmarking Customer Acquisition Cost (CAC) involves comparing your company’s CAC to industry benchmarks to assess performance and identify areas for improvement. By understanding how your CAC measures up against competitors or industry averages, you can make informed decisions to optimize your customer acquisition strategies.

Industry Benchmarks for CAC

Industry benchmarks for CAC can vary widely depending on the sector and business model. For example, SaaS companies typically have higher CAC compared to e-commerce businesses due to longer sales cycles and higher customer lifetime values. In general, CAC benchmarks can range from a few hundred dollars to several thousand dollars, but it’s crucial to analyze data specific to your industry and target market.

- Software as a Service (SaaS): Average CAC of $1,000 – $5,000

- E-commerce: Average CAC of $50 – $200

- Telecommunications: Average CAC of $200 – $500

- Financial Services: Average CAC of $500 – $1,000

Tip: Research industry reports, case studies, and market data to determine relevant benchmarks for your business.

Using Benchmarking to Improve CAC

Businesses can leverage benchmarking to enhance their CAC by identifying inefficiencies, optimizing marketing channels, and refining targeting strategies. By analyzing industry benchmarks, companies can set realistic goals, track progress, and implement data-driven decisions to lower their CAC and improve overall profitability.

- Compare CAC to competitors: Evaluate how your CAC compares to industry leaders and identify areas for improvement.

- Experiment with new channels: Test different marketing channels and tactics to identify cost-effective acquisition strategies.

- Refine targeting: Segment your audience, personalize messaging, and optimize conversion funnels to reduce acquisition costs.

- Monitor performance: Regularly track CAC metrics, analyze trends, and adjust strategies to meet or beat industry benchmarks.