When it comes to disability insurance claims, get ready to dive into the world of securing coverage and understanding the claim process like a pro. From knowing what disability insurance claims entail to unraveling the steps to successful filing, this journey is packed with valuable insights and tips to empower you.

Overview of Disability Insurance Claims

Disability insurance claims are requests made by individuals to their insurance provider for financial assistance when they are unable to work due to a disability. This type of insurance provides income replacement to policyholders who are unable to perform the duties of their occupation due to a disability.

Examples of Situations Requiring Disability Insurance Claims

- An individual injures their back in a car accident and is unable to return to work for an extended period.

- A person is diagnosed with a chronic illness that prevents them from working full-time.

- Someone experiences a mental health condition that impacts their ability to perform their job duties.

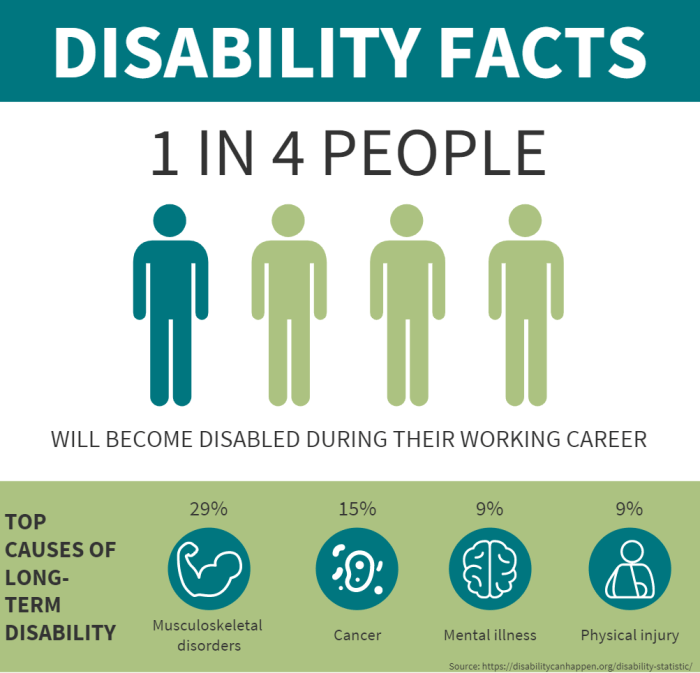

Importance of Having Disability Insurance Coverage

Having disability insurance coverage is crucial as it provides financial protection in case of unexpected disabilities that result in the inability to work. Without this coverage, individuals risk facing significant financial hardship if they are unable to earn an income due to a disability. Disability insurance ensures that individuals can still meet their financial obligations and maintain their standard of living during challenging times.

Types of Disability Insurance

When it comes to disability insurance, there are different types available to individuals based on their needs and circumstances. The two main types are short-term disability insurance and long-term disability insurance. Let’s dive into the details of each type and compare their coverage.

Short-Term Disability Insurance

Short-term disability insurance typically provides coverage for a shorter period, usually ranging from a few weeks to a few months. It is designed to replace a portion of your income if you are unable to work due to a temporary disability, such as a medical condition or injury. This type of insurance can kick in quickly after a waiting period, providing financial support during the initial stages of your disability.

Long-Term Disability Insurance, Disability insurance claims

On the other hand, long-term disability insurance offers coverage for a more extended period, often lasting for several years or until retirement age. This type of insurance is suitable for individuals facing a more severe and long-lasting disability that prevents them from working for an extended period. Long-term disability insurance provides a more comprehensive level of coverage compared to short-term disability insurance, offering financial protection for a longer duration.

Choosing the Right Type of Disability Insurance

When determining which type of disability insurance suits your needs best, consider factors such as your health condition, the nature of your occupation, and your financial obligations. If you have a job with more physical demands or higher risks of injury, long-term disability insurance may be more suitable to provide long-lasting protection. On the other hand, if you have a job with less physical risks and a shorter recovery period for disabilities, short-term disability insurance may be sufficient to cover your needs.

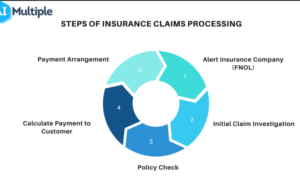

Process of Filing Disability Insurance Claims

When it comes to filing a disability insurance claim, it’s essential to follow a specific process to ensure your claim is successful. Here, we will Artikel the step-by-step process of filing a disability insurance claim, provide tips for preparing and submitting a successful claim, and discuss common challenges individuals may face during the claims process and how to overcome them.

Step-by-Step Process of Filing a Disability Insurance Claim

- Gather necessary documentation, such as medical records, doctor’s notes, and any other relevant paperwork.

- Fill out the claim forms provided by your insurance company accurately and completely.

- Submit the completed forms along with all required documentation to your insurance company within the specified timeframe.

- Wait for your claim to be reviewed by the insurance company, which may involve a medical examination or additional information requests.

- Receive a decision on your claim from the insurance company, either approving or denying benefits.

Tips for Preparing and Submitting a Successful Disability Insurance Claim

- Keep detailed records of all medical treatment related to your disability.

- Provide clear and concise information on how your disability impacts your ability to work.

- Submit all required documentation promptly and accurately.

- Follow up with your insurance company regularly to ensure the timely processing of your claim.

- Consider seeking assistance from a disability advocate or attorney to help navigate the claims process.

Common Challenges During the Claims Process and How to Overcome Them

- Delays in processing: Stay organized and keep track of all communication with your insurance company to prevent delays.

- Insufficient documentation: Make sure to provide all necessary medical records and information to support your claim.

- Claim denial: If your claim is denied, you have the right to appeal the decision. Seek assistance from a legal professional if needed.

- Communication issues: Maintain open lines of communication with your insurance company and be proactive in providing updates on your condition.

Reasons for Disability Insurance Claims Denials

When it comes to disability insurance claims, denials can be frustrating and overwhelming. It’s important to understand the common reasons why these claims are denied, as well as what individuals can do if they find themselves in this situation.

One of the most common reasons for disability insurance claims denials is a lack of sufficient medical evidence to support the claim. Insurance companies require detailed documentation from healthcare providers to prove the extent of the disability and its impact on the individual’s ability to work.

Another reason for denials could be errors or inaccuracies in the claim forms. It’s crucial to double-check all information provided in the claim to ensure accuracy and completeness.

Sometimes, claims are denied due to pre-existing conditions not being disclosed or excluded from coverage. It’s important for individuals to be transparent about their medical history when applying for disability insurance.

If your disability insurance claim is denied, there are steps you can take to appeal the decision. Start by reviewing the denial letter carefully to understand the reasons for the denial. Then, gather any additional evidence or documentation that may support your claim.

When appealing a denied disability insurance claim, it’s essential to follow the insurance company’s appeal process and deadlines. Seek assistance from a legal professional or disability advocate if needed to navigate the appeals process effectively.

Remember that persistence and patience are key when appealing a denied disability insurance claim. By staying organized, gathering supporting evidence, and following the proper procedures, you can increase your chances of a successful appeal.

Impact of Medical Evidence on Disability Insurance Claims

When it comes to disability insurance claims, having strong medical evidence to support your case is crucial. Insurance companies rely heavily on medical documentation to determine the validity of a claim and the extent of the disability. Without sufficient medical evidence, your claim may be denied or delayed.

Importance of Medical Evidence

- Medical records: Detailed medical records from healthcare providers outlining your diagnosis, treatment plan, and prognosis are essential.

- Physician statements: Statements from treating physicians describing your limitations, restrictions, and inability to work are key pieces of evidence.

- Test results: Any relevant test results, such as MRIs, X-rays, or lab reports, can provide objective evidence of your condition.

- Medication history: Documentation of prescribed medications and their side effects can further support your claim.

Ensuring Sufficient Medical Documentation

- Regular doctor visits: Stay consistent with medical appointments and follow your treatment plan to maintain up-to-date medical records.

- Communication: Clearly communicate your symptoms, limitations, and how they affect your daily life to your healthcare providers.

- Keep records: Keep copies of all medical records, test results, and correspondence related to your disability for easy access when filing a claim.

- Consult with specialists: If necessary, seek opinions from specialists or experts in your condition to strengthen your case.