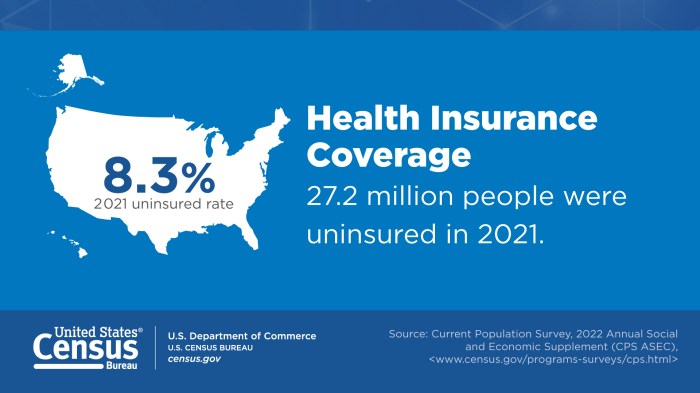

Health insurance coverage is a crucial aspect of life, ensuring access to quality healthcare and financial stability during emergencies. Let’s dive into the details of this essential topic.

From different types of plans to understanding premiums, deductibles, and copayments, we’ll explore everything you need to know about health insurance coverage.

Importance of Health Insurance Coverage

Having health insurance coverage is crucial for individuals and families as it provides financial protection and ensures access to quality healthcare services when needed. In today’s world, where medical costs are constantly on the rise, having health insurance can make a significant difference in one’s life.

Benefits of Health Insurance

- Access to Quality Healthcare: Health insurance allows individuals to seek timely medical attention without worrying about the high costs associated with treatments, medications, and procedures.

- Preventive Care: Health insurance often covers preventive services like vaccinations, screenings, and check-ups, which can help in early detection and treatment of health issues.

- Financial Stability: Health insurance provides a safety net during unexpected medical emergencies, preventing individuals from facing overwhelming medical bills that could lead to financial ruin.

Types of Health Insurance Plans: Health Insurance Coverage

When it comes to health insurance, there are several types of plans available that offer different coverage options and cost structures. Understanding the differences between HMOs, PPOs, EPOs, and POS plans can help you choose the one that best fits your needs.

Health Maintenance Organization (HMO)

An HMO plan typically requires you to choose a primary care physician (PCP) who will coordinate all your healthcare needs. You must get a referral from your PCP to see a specialist. HMOs usually have lower out-of-pocket costs but limit your choice of healthcare providers.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers. You can see specialists without a referral, both in-network and out-of-network, although you will pay less if you stay in-network. PPOs generally have higher premiums and out-of-pocket costs compared to HMOs.

Exclusive Provider Organization (EPO)

EPO plans are similar to PPOs in terms of provider flexibility, but they do not cover any out-of-network care except in emergencies. EPOs typically have lower premiums than PPOs but may have higher out-of-pocket costs.

Point of Service (POS)

POS plans combine elements of HMOs and PPOs. You choose a primary care physician and need referrals to see specialists, like in an HMO. However, you can also see out-of-network providers, like in a PPO, but at a higher cost. POS plans offer a balance between cost and provider choice.

Each type of health insurance plan has its own set of advantages and disadvantages, so it’s important to consider your healthcare needs and budget when selecting the right plan for you.

Understanding Premiums, Deductibles, and Copayments

Health insurance lingo can get a bit confusing, but understanding premiums, deductibles, and copayments is crucial to knowing how much you’ll pay for healthcare. Let’s break it down!

Premiums are like a monthly subscription fee you pay to your insurance company to keep your coverage active. It’s basically the cost of having insurance, regardless of whether you use it or not.

Deductibles are the amount you have to pay out of pocket for healthcare services before your insurance kicks in. For example, if you have a $1,000 deductible, you’ll need to pay that amount before your insurance starts covering costs.

Copayments are fixed amounts you pay for specific services, like doctor visits or prescriptions, after you’ve met your deductible. It’s usually a set fee, such as $20 for a doctor visit or $10 for generic prescriptions.

Impact on Out-of-Pocket Costs

When it comes to out-of-pocket costs, premiums, deductibles, and copayments all play a role. Lower premiums might seem appealing, but they often come with higher deductibles and copayments, meaning you’ll pay more when you actually need care.

On the other hand, higher premiums usually mean lower deductibles and copayments, leading to lower out-of-pocket costs for healthcare services. It’s a balancing act between what you pay monthly versus what you pay when you receive care.

Examples in Different Health Insurance Plans, Health insurance coverage

- High Deductible Health Plan (HDHP): HDHPs typically have lower premiums but higher deductibles. For example, a plan with a $3,000 deductible and $50 copay for doctor visits.

- Preferred Provider Organization (PPO): PPOs often have higher premiums but lower deductibles and copays. You might see a plan with a $500 deductible and $20 copay for specialist visits.

- Health Maintenance Organization (HMO): HMOs usually have low copays but higher premiums. An HMO plan might have a $20 copay for primary care visits and $10 copay for generic prescriptions.

Coverage for Pre-Existing Conditions

Having a pre-existing condition means that an individual has a health issue that existed before they enrolled in a new health insurance plan. These conditions can range from asthma and diabetes to cancer and heart disease.

Affordable Care Act (ACA) Impact

The Affordable Care Act (ACA) has had a significant impact on coverage for pre-existing conditions. Under the ACA, insurance companies are required to cover pre-existing conditions and cannot deny coverage or charge higher premiums based on these conditions. This provision ensures that individuals with pre-existing conditions have access to the health insurance coverage they need.

Importance of Ensuring Coverage

Ensuring coverage for pre-existing conditions is crucial for individuals with ongoing health issues. Without this coverage, individuals may not be able to afford necessary medical treatments, medications, or doctor’s visits. By guaranteeing coverage for pre-existing conditions, health insurance policies provide peace of mind and financial security for those managing chronic illnesses.