Loan approval process sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

When it comes to navigating the world of loans, understanding the approval process is key to securing financial support for your goals. From documentation requirements to credit score assessments, every step plays a crucial role in determining your success. Let’s dive into the intricacies of the loan approval process and unlock the secrets to financial empowerment.

Loan Approval Process Overview

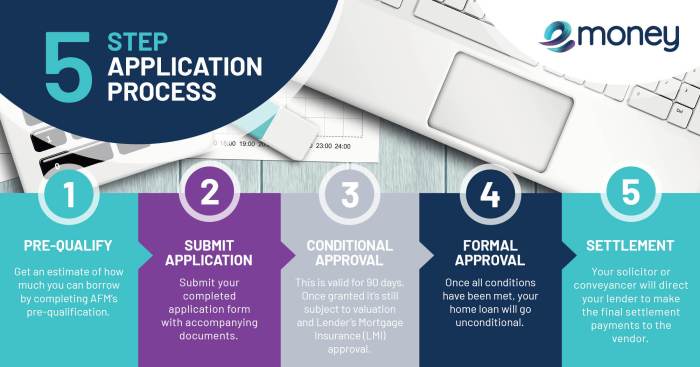

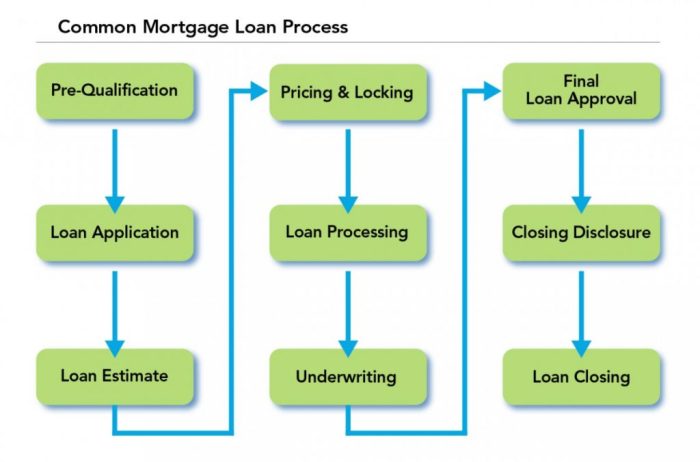

When it comes to getting a loan approved, there are several key steps involved in the process. It’s crucial to understand how this process works to ensure a successful outcome.

General Steps in the Loan Approval Process

- Application Submission: The borrower submits a loan application with all necessary documentation.

- Document Verification: The financial institution verifies the information provided in the application.

- Credit Check: A credit check is performed to assess the borrower’s creditworthiness.

- Approval Decision: The lender reviews all the information and makes a decision to approve or deny the loan.

- Loan Disbursement: If approved, the loan amount is disbursed to the borrower.

Key Stakeholders and Their Roles

- Borrower: Submits the loan application and provides necessary documentation.

- Lender: Reviews the application, conducts credit checks, and makes the final approval decision.

- Underwriter: Assesses the risk associated with the loan and determines if it meets the lender’s criteria.

- Loan Processor: Coordinates the various steps in the approval process and ensures all documentation is in order.

Importance of a Thorough Loan Approval Process

A thorough loan approval process is essential for financial institutions to mitigate risks and ensure that loans are granted to creditworthy individuals. By verifying information, conducting credit checks, and assessing the borrower’s ability to repay, lenders can make informed decisions that protect their interests and maintain the stability of the financial system.

Documentation Required

To get your loan approved, you need to have the right documentation in place. Each document serves a specific purpose in the approval process and ensures that you meet the necessary requirements. Let’s break down the common documents needed for a loan application and why they are crucial for the approval process.

List of Common Documents

- Photo ID (Driver’s License, Passport, or State ID): This document is essential for verifying your identity and ensuring that you are who you claim to be.

- Proof of Income (Pay Stubs, Tax Returns, or W-2 Forms): Lenders need to see that you have a stable income to repay the loan. Providing proof of income helps assess your ability to make timely payments.

- Bank Statements: Lenders review your bank statements to evaluate your financial stability and track record of managing money. It gives them insight into your spending habits and helps determine your eligibility for a loan.

- Proof of Address (Utility Bills, Lease Agreement, or Mortgage Statement): Verifying your current address is crucial for the approval process. It confirms your residency status and ensures that you can be reached for important communications.

- Credit Report: Your credit report provides a comprehensive overview of your credit history, including your credit score and payment history. Lenders use this information to assess your creditworthiness and determine the terms of your loan.

Impact of Documentation Accuracy and Completeness

Having accurate and complete documentation plays a significant role in expediting the loan approval process. When you provide all the required documents accurately, it helps streamline the verification process and reduces the chances of delays. Incomplete or inaccurate documentation can lead to additional requests for information, causing delays in the approval timeline. By ensuring that all your documents are in order and up to date, you can help speed up the approval process and increase your chances of getting the loan you need.

Credit Score Assessment

In the loan approval process, credit scores play a crucial role in determining an individual’s creditworthiness. Lenders use credit scores as a tool to assess the risk of lending money to a borrower. A higher credit score indicates responsible financial behavior, making it more likely for the borrower to repay the loan on time.

Significance of Credit Scores

- Lenders evaluate credit scores to determine the interest rate for the loan.

- A good credit score can lead to lower interest rates and better loan terms.

- Credit scores can impact the approval decision and loan amount offered to the borrower.

Evaluation of Credit Scores by Lenders

- Lenders typically use credit reporting agencies to obtain credit reports and scores.

- Credit scores are usually calculated based on payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

- Lenders set minimum credit score requirements for different types of loans.

Improving Credit Scores

- Pay bills on time to avoid late payments and collections.

- Keep credit card balances low and avoid maxing out credit limits.

- Regularly check credit reports for errors and dispute any inaccuracies.

- Avoid opening multiple new credit accounts in a short period.

- Use credit responsibly and maintain a good credit history over time.

Income Verification

When it comes to getting approved for a loan, income verification is a key step in the process. Lenders need to ensure that borrowers have a steady source of income to repay the loan. Let’s dive into the methods used by lenders to verify a borrower’s income and why it is so important.

Methods of Income Verification

- Pay Stubs: Lenders often request pay stubs from borrowers to verify their income. This provides a snapshot of the borrower’s earnings over a specific period.

- Tax Returns: Another common method is to review the borrower’s tax returns. This can give a more comprehensive view of their income over time.

- Bank Statements: Lenders may also ask for bank statements to confirm regular deposits and assess the borrower’s financial stability.

Importance of Income Verification

Income verification is critical because it helps lenders assess the borrower’s ability to repay the loan. By confirming a steady income, lenders can have more confidence in the borrower’s financial stability and reduce the risk of default. Without proper income verification, lenders may be hesitant to approve a loan due to uncertainty about the borrower’s repayment capacity.

Comparison of Income Verification Processes

| Method | Effectiveness |

|---|---|

| Pay Stubs | Provides a current snapshot of income but may not capture irregular or additional sources of income. |

| Tax Returns | Offers a more detailed view of income over time but may not reflect recent changes in income. |

| Bank Statements | Shows regular deposits and overall financial stability but may not provide a clear picture of income sources. |

Approval Criteria

When it comes to approving a loan, lenders consider several key factors to assess the applicant’s creditworthiness. These factors include credit score, income level, debt-to-income ratio, employment history, and collateral.

Types of Loans

- Mortgage: For mortgage loans, lenders pay close attention to the applicant’s credit score, income stability, down payment amount, and property value. A higher credit score and a lower debt-to-income ratio can increase the chances of approval.

- Personal: Personal loans may have more flexible approval criteria compared to mortgages. Lenders may focus on the applicant’s income level, credit history, and employment status. However, interest rates for personal loans are often higher to offset the risk.

- Business: Business loans require a strong business plan, financial statements, and collateral. Lenders evaluate the business’s profitability, credit history, and industry stability to determine approval.

Approval Scenarios

- Meeting Criteria: An applicant with a high credit score, stable income, and low debt-to-income ratio is likely to meet the approval criteria for a loan. Good credit history and a solid financial background also increase the chances of approval.

- Failing to Meet Criteria: On the other hand, applicants with a low credit score, inconsistent income, high debt levels, or lack of collateral may fail to meet the approval criteria. Lenders may see them as high-risk borrowers and reject their loan applications.

Decision Making Process: Loan Approval Process

In the loan approval process, lenders make crucial decisions that determine whether an applicant qualifies for a loan or not. These decisions are based on various factors such as credit score, income verification, and approval criteria.

Role of Automated Systems vs Manual Review

Automated systems play a significant role in the decision-making process by quickly analyzing and processing large amounts of data. These systems can provide instant feedback on an applicant’s creditworthiness based on predefined criteria. On the other hand, manual review involves human intervention to assess more complex cases or exceptions that automated systems may not accurately evaluate. Lenders often use a combination of both automated systems and manual review to ensure thorough evaluation of loan applications.

Impact of External Factors

External factors, such as economic conditions, can influence loan approval decisions. During economic downturns, lenders may tighten their lending criteria to reduce risk exposure. This can make it more challenging for applicants to secure a loan, even if they meet the standard requirements. On the contrary, during economic upswings, lenders may be more lenient in their approval process, considering the overall positive economic outlook. It is essential for applicants to be aware of these external factors and how they can affect their loan approval chances.