Looking for some solid mortgage advice? Well, you’ve come to the right place. Let’s dive into the world of mortgages and explore everything you need to know to make informed decisions about your home financing.

From understanding different mortgage types to navigating the application process and securing the best rates, we’ve got you covered every step of the way.

Types of Mortgages

When it comes to mortgages, there are several types to choose from based on your financial situation and needs. Let’s take a look at some of the most common options available in the market.

Fixed-Rate Mortgages

Fixed-rate mortgages have a set interest rate that remains the same throughout the life of the loan. This means your monthly payments will also remain constant, providing predictability and stability. These mortgages are ideal for borrowers who prefer consistency and want to avoid fluctuations in their payments.

Adjustable-Rate Mortgages

On the other hand, adjustable-rate mortgages (ARMs) have an interest rate that can change periodically based on market conditions. While initial rates are typically lower than fixed-rate mortgages, they can increase over time, leading to higher payments. ARMs are suitable for borrowers who plan to sell or refinance before the rate adjusts.

Government-Insured Mortgages (FHA Loans) vs. Conventional Mortgages

Government-insured mortgages like FHA loans are backed by the Federal Housing Administration and offer benefits such as lower down payment requirements and flexible credit guidelines. They are ideal for first-time homebuyers or those with less-than-perfect credit. On the other hand, conventional mortgages are not insured or guaranteed by the government and often require higher credit scores and down payments. However, they may offer more flexibility in terms of loan terms and options.

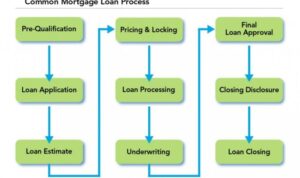

Mortgage Application Process: Mortgage Advice

When it comes to applying for a mortgage, there are several key steps involved in the process to help you secure the loan you need for your dream home.

Documentation Required

- Gather important documents such as proof of income, tax returns, bank statements, and identification.

- Provide details about your employment history, assets, and any outstanding debts you may have.

- Prepare documentation related to the property you wish to purchase, such as the purchase agreement and property appraisal.

Credit Score and Income Verification

- Your credit score plays a crucial role in determining your eligibility for a mortgage and the interest rate you may receive.

- Lenders will verify your income to ensure you have the financial stability to repay the loan.

- Having a good credit score and stable income can increase your chances of mortgage approval and help you secure favorable loan terms.

Mortgage Rates and Payments

When it comes to mortgages, understanding how rates are determined and how they affect your monthly payments is crucial. Let’s dive into the details.

Factors Influencing Mortgage Rates

Mortgage rates are determined by lenders based on a variety of factors, including:

- Current economic conditions

- The borrower’s credit score

- The loan amount and down payment

- Type of mortgage (fixed-rate or adjustable-rate)

- The length of the loan term

Strategies for Finding the Best Mortgage Rates

To secure the best mortgage rates, consider the following strategies:

- Improve your credit score before applying

- Shop around and compare rates from multiple lenders

- Consider paying points to lower your interest rate

- Choose the right type of mortgage for your financial situation

Understanding Monthly Mortgage Payments, Mortgage advice

Your monthly mortgage payment is influenced by several factors, including:

- The loan amount and interest rate

- Property taxes and homeowners insurance

- Private mortgage insurance (if applicable)

- The length of the loan term

Mortgage Refinancing

When you refinance your mortgage, you essentially replace your current home loan with a new one. This new loan comes with different terms, such as a new interest rate, loan duration, or monthly payments. People usually refinance their mortgages to take advantage of lower interest rates, reduce monthly payments, or tap into their home equity for other financial goals.

Pros and Cons of Refinancing a Mortgage

- Pros:

- Lower interest rates: Refinancing can help you secure a lower interest rate, potentially saving you money over the life of the loan.

- Lower monthly payments: By extending the loan term or securing a lower interest rate, you can reduce your monthly mortgage payments.

- Access home equity: Refinancing allows you to tap into your home equity for things like home improvements or debt consolidation.

- Cons:

- Closing costs: Refinancing comes with closing costs, which can add up to thousands of dollars and may negate potential savings.

- Extended loan term: If you refinance to lower your monthly payments by extending the loan term, you may end up paying more interest over time.

- Resetting the clock: Refinancing restarts the mortgage term, which means you’ll be paying on the loan for a longer period.

Process of Refinancing a Mortgage and Considerations

- Evaluate your current loan: Review your current mortgage terms, interest rate, and remaining balance to determine if refinancing makes financial sense.

- Shop for lenders: Compare offers from multiple lenders to find the best refinancing deal with favorable terms and closing costs.

- Submit an application: Once you’ve chosen a lender, complete the application process, providing the necessary documents and financial information.

- Appraisal and underwriting: The lender will order an appraisal of your home to determine its value and review your financial details to approve the refinance.

- Closing: Sign the new loan documents, pay any closing costs, and officially refinance your mortgage.