Diving into renter’s insurance options, this intro sets the stage for understanding the importance of coverage for tenants. From different policy types to key factors in decision-making, we’re about to break it all down.

Get ready to navigate the world of renter’s insurance like a pro with this comprehensive guide.

Overview of Renter’s Insurance Options

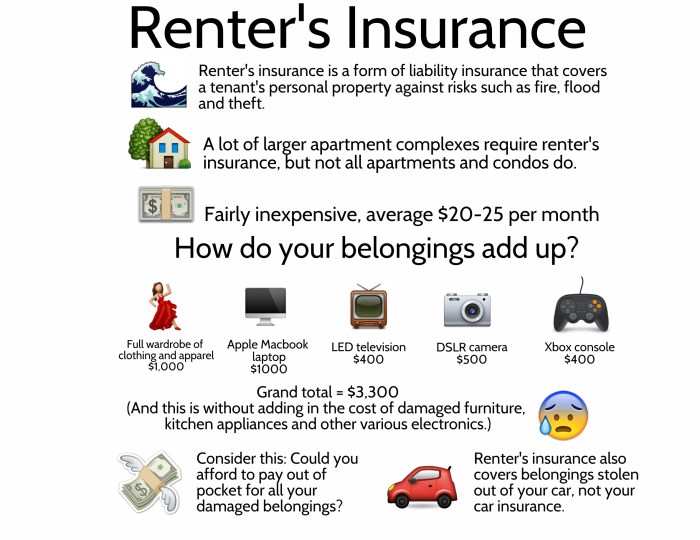

When renting a home or apartment, it’s crucial to protect your belongings and yourself with renter’s insurance. This type of insurance provides coverage for your personal property in case of theft, damage, or loss, as well as liability protection if someone is injured on your rented property. Here’s an overview of different types of renter’s insurance policies available and key factors to consider when selecting a plan.

Types of Renter’s Insurance Policies

- Actual Cash Value: This policy covers the actual cash value of your belongings, taking into account depreciation.

- Replacement Cost: With this policy, you will receive the full replacement cost of your items without considering depreciation.

- Liability Coverage: This protects you if someone is injured on your property and covers legal fees and medical expenses.

Key Factors to Consider

- Determine the value of your possessions to choose the right coverage amount.

- Check if the policy includes additional living expenses if you need to relocate temporarily due to a covered event.

- Review the liability coverage limits to ensure they are sufficient to protect your assets in case of a lawsuit.

Standard Coverage vs. Additional Coverage

When it comes to renter’s insurance, understanding the difference between standard coverage and additional coverage options is essential for making informed decisions to protect your belongings.

Standard coverage typically includes protection for personal belongings, liability coverage, and additional living expenses in case your rented home becomes uninhabitable due to a covered loss. However, there are limitations to standard coverage that may not fully protect all your assets.

Additional Coverage Options

- Renters’ insurance floaters: These provide additional coverage for high-value items like jewelry, art, or electronics that exceed the limits of your standard policy.

- Identity theft protection: This coverage helps you recover from identity theft-related expenses, such as legal fees or lost wages due to resolving the issue.

- Water backup coverage: Protects you from water damage caused by backed-up drains or sump pumps, which may not be included in standard policies.

- Earthquake or flood insurance: If you live in an area prone to these natural disasters, adding this coverage can safeguard your belongings and living space.

Benefits of Additional Coverage

- Peace of mind: Knowing that your high-value items are fully protected can give you peace of mind in case of theft or damage.

- Customized protection: Additional coverage options allow you to tailor your policy to your specific needs, ensuring comprehensive protection for your assets.

- Financial security: Opting for extra coverage can prevent unexpected expenses from derailing your finances in the event of a covered loss.

Cost Factors and Premiums: Renter’s Insurance Options

When it comes to renter’s insurance, understanding how premiums are calculated and what factors can affect the cost is crucial. By knowing these details, renters can make informed decisions and potentially lower their insurance costs.

Premium Calculation

- Renter’s insurance premiums are typically determined based on various factors, including the coverage amount, deductible chosen, location of the rental property, and the renter’s claims history.

- Insurance companies also consider the type of coverage selected (standard or additional coverage) and any additional endorsements or riders added to the policy.

- The insurance company will assess the level of risk associated with insuring the rental property and the renter, which can impact the final premium amount.

Factors Affecting Cost, Renter’s insurance options

- The location of the rental property plays a significant role in determining insurance costs. Properties in high-crime areas or regions prone to natural disasters may have higher premiums.

- The coverage amount and deductible chosen can also affect the cost. Opting for higher coverage limits or lower deductibles will generally result in higher premiums.

- A renter’s credit score and claims history can impact insurance costs. Those with poor credit or a history of frequent claims may face higher premiums.

Tips to Lower Insurance Costs

- Consider bundling renter’s insurance with other policies, such as auto insurance, to qualify for multi-policy discounts.

- Installing safety features in the rental property, such as smoke alarms, deadbolts, and security systems, can help reduce insurance costs.

- Review the coverage amount and deductible regularly to ensure they align with your needs. Adjusting these factors can help lower premiums.

- Shop around and compare quotes from different insurance companies to find the most competitive rates for renter’s insurance.

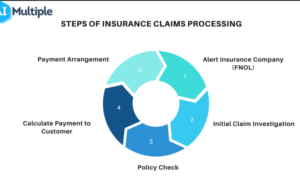

Claims Process and Coverage Limits

When it comes to renter’s insurance, understanding the claims process and coverage limits is crucial for protecting your belongings in case of unexpected events.

Explainatory paragraph:

The typical process of filing a claim with renter’s insurance involves contacting your insurance provider, providing details of the incident, and submitting any necessary documentation such as police reports or receipts. Once the claim is approved, you may receive compensation for the damaged or stolen items based on your coverage limits.

Coverage Limits Impact

- Coverage limits refer to the maximum amount your insurance policy will pay out in the event of a claim. If your coverage limit is lower than the value of your belongings, you may not receive full compensation for your losses.

- For example, if your coverage limit for personal property is $20,000 and your belongings are worth $30,000, you would only receive up to $20,000 in compensation.

- Coverage limits can vary depending on the type of coverage you have, so it’s important to review your policy and make sure you have adequate coverage for your needs.