Exploring the world of renter’s insurance options, get ready to dive into the importance, coverage types, and benefits in a way that’s fresh and engaging.

Overview of Renter’s Insurance Options

When it comes to renting a home or apartment, having renter’s insurance is crucial to protect your belongings and provide liability coverage. Renter’s insurance offers financial protection in case of theft, fire, or other unexpected events, giving tenants peace of mind knowing they are covered.

Types of Coverage in Renter’s Insurance Policies

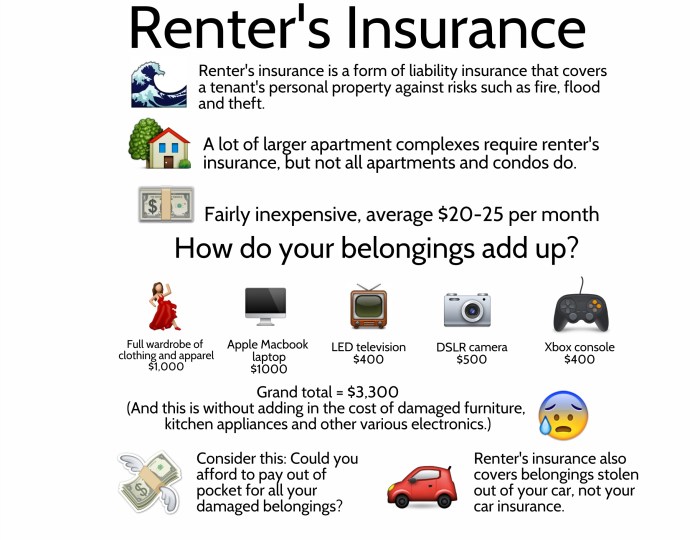

Renter’s insurance typically includes two main types of coverage: personal property coverage and liability coverage. Personal property coverage helps replace or repair your belongings if they are damaged or stolen, while liability coverage protects you if someone is injured in your rental property.

- Personal Property Coverage: This type of coverage includes protection for your personal belongings such as furniture, electronics, and clothing. It helps cover the cost of replacing or repairing these items in case of damage or theft.

- Liability Coverage: Liability coverage comes into play if someone is injured on your rental property and decides to file a lawsuit against you. This coverage helps with legal fees and medical expenses, providing you with financial protection.

Key Benefits of Renter’s Insurance

Renter’s insurance offers several key benefits that make it a worthwhile investment for tenants:

- Financial Protection: Renter’s insurance provides financial protection in case of unexpected events like theft, fire, or vandalism. It helps cover the cost of replacing or repairing your belongings, saving you from significant out-of-pocket expenses.

- Peace of Mind: Knowing that you have renter’s insurance in place can give you peace of mind, allowing you to focus on enjoying your rental property without worrying about potential risks.

- Affordability: Renter’s insurance is generally affordable, with monthly premiums that are budget-friendly. It offers a cost-effective way to protect your belongings and assets.

Standard Coverage vs. Optional Coverage: Renter’s Insurance Options

When it comes to renter’s insurance, understanding the difference between standard coverage and optional add-ons is crucial in protecting yourself and your belongings.

Standard Coverage

- Personal Property: This includes coverage for your personal belongings such as furniture, electronics, and clothing in case of theft, fire, or other covered events.

- Liability: Protects you in case someone is injured in your rental unit and you are found legally responsible. It can also cover property damage caused by you or your family members.

- Additional Living Expenses: If your rental unit becomes uninhabitable due to a covered event, this coverage helps pay for temporary living arrangements like hotel stays or rental expenses.

Optional Coverage

- Identity Theft Protection: This add-on can help cover expenses related to identity theft, such as legal fees, lost wages, and credit monitoring services.

- Earthquake Coverage: In areas prone to earthquakes, adding this coverage can protect your belongings and provide coverage for damage caused by seismic activity.

Cost Factors and Considerations

When it comes to the cost of renter’s insurance, there are several factors that can influence how much you’ll pay. Insurance providers take into account things like the location of your rental property, the coverage limits you choose, your deductible amount, and even your credit score. Understanding these factors can help you make an informed decision when selecting a policy.

Factors Influencing Cost

- The location of your rental property plays a big role in determining your insurance premium. If you live in an area prone to natural disasters or high crime rates, you may end up paying more for coverage.

- Choosing higher coverage limits will also increase your premium since the insurance company will have to pay out more in case of a claim.

- Your deductible amount is another key factor. A higher deductible means lower premiums, but you’ll have to pay more out of pocket before your insurance kicks in.

- Some insurance providers may also consider your credit score when calculating your premium. A higher credit score could mean lower rates.

Pricing Comparison, Renter’s insurance options

| Insurance Provider | Average Monthly Premium |

|---|---|

| Provider A | $20 |

| Provider B | $25 |

| Provider C | $18 |

Discounts for Renters

- Some insurance companies offer discounts if you have multiple policies with them, such as auto and renter’s insurance bundled together.

- Installing safety features in your rental property, like smoke detectors and security alarms, could also make you eligible for discounts.

- Being a non-smoker or having good credit can sometimes qualify you for lower rates.

Selecting the Right Policy

When it comes to choosing the right renter’s insurance policy, it’s essential to assess your personal needs and evaluate insurance providers for reliability and customer service.

Assessing Personal Needs

- Consider the value of your belongings and select coverage that adequately protects them.

- Think about potential risks in your area, such as natural disasters or theft, and choose coverage accordingly.

- Evaluate if you need additional coverage for high-value items like jewelry or electronics.

Evaluating Insurance Providers

- Research different insurance companies to compare coverage options and pricing.

- Check customer reviews and ratings to gauge the reliability and quality of service provided by each insurer.

- Look for insurance companies with a good claims process and responsive customer support for peace of mind.